MEMBER SURVEY 2025

Our annual member survey identifies the key trends, challenges, and opportunities facing the consulting sector in the UK.

Foreword

Every year starts with fresh ambitions and optimism, and the prospects for the consultancy sector in 2025 are no different in this regard.

The past year has been marked by economic challenges, including geopolitical instability and high inflation, yet the resilience of the consulting sector highlights the perseverance and adaptability of its members. Despite some setbacks, nearly three-quarters of consulting leaders report performance that met or exceeded expectations.

Encouragingly, leaders anticipate a rebound in client demand, reinforcing the sector’s position as a government-recognised driver of growth.

The latest Member Survey highlights the fast-paced nature of the consulting market and the shifting priorities of its members. Pressing challenges and issues continue to evolve, reflecting the sector’s dynamic environment.

Consultancies are responding to volatility by evolving their services to meet client needs and hiring experienced talent. Additionally, the focus on supporting employees, especially through increased training opportunities for younger consultants, underscores the industry’s commitment to its people.

Long-term changes are also evident, such as the significant decline in hires from Russell Group universities, reflecting a push for greater diversity and societal representation. More firms are expanding regionally, with offices opening beyond the capital.

Looking ahead, the industry must stay agile, particularly as demand shifts from sustainability services to AI-driven solutions. Expanding talent pools, optimising resources, and prioritising employee satisfaction, such as flexible working, will be key areas of focus.

The survey sheds light on the diverse needs and challenges within the sector, from generational differences to disparities between small and large consultancies. It provides a snapshot of the market, fostering conversations to help the industry navigate its challenges and maintain its role as a trusted partner to governments and businesses.

This survey is just the start of that conversation, and we hope you find it useful.

Tamzen

Isacsson

Chief Executive

Survey Overview

GROWTH IN 2024

FORECAST GROWTH IN 2025

GROWTH IN 2025/26

VIEW OF CONSULTANTS

YOUNG MCA - RUSSELL GROUP

CONSULTANCY SERVICES EXPECTED TO INCREASE IN 2025

FACTORS DRIVING GROWTH IN 2024

"Market shift towards digital and technology transformation including Gen AI growth in specific industries."

Owner/MD, larger firm

Executive Summary

Our membership

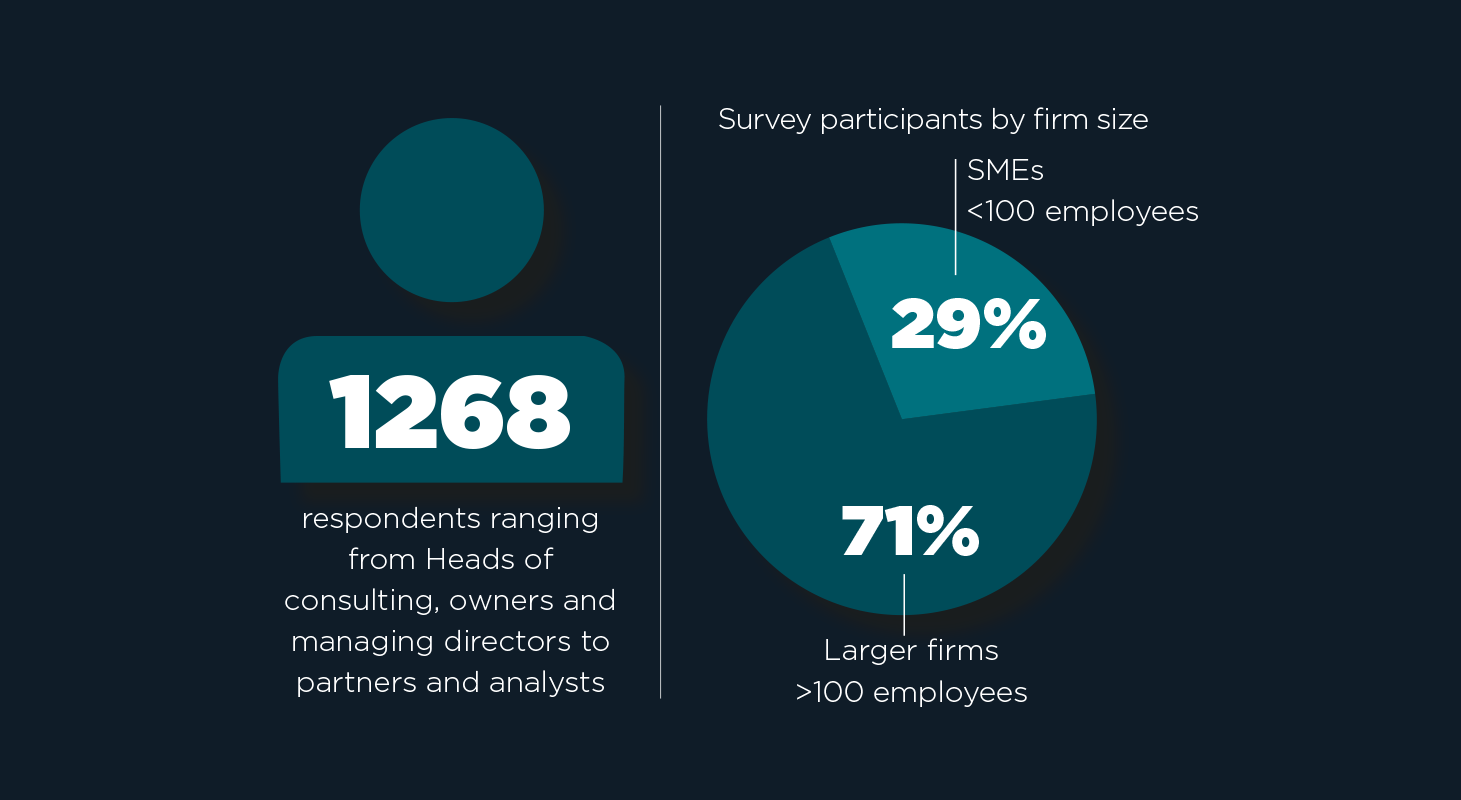

The MCA membership represents a wide range of firm sizes, service specialisms and sector expertise.

Just over two-thirds of the membership are classed as ‘large firms’ (>100 full-time consulting staff); a third of the membership is made up of SME firms (<100 full-time consulting staff).

1268 consultants from MCA member firms responded to the member survey, representing management consultants from Analysts to Heads of Consulting.

2024: Year in review

Last year marked a significant shift in the UK’s political landscape with a change in government for the first time in 14 years.

This transition introduced business uncertainty, compounded by ongoing economic turbulence as the UK continued to grapple with inflation and tough market conditions. On a global scale, events such as the US presidential election and ongoing conflicts in the Middle East and Ukraine further influenced the market, enhancing uncertainty regarding what 2025 will bring as the Government’s budgetary outlook and policies take shape. Despite these political and economic upheavals, the management consulting industry has demonstrated resilience and adaptability to meet market demands.

2025-26: Looking ahead

Looking forward into 2025, estimates provided by MCA council representatives suggest that the consulting sector will grow by 6.4% in the next 12 months, and by 8.7% in 2026 – a return to more normal levels of growth than we have experienced in recent years.

This positive outlook reflects more stable economic and political conditions with both inflation and interest rates coming down. Clients are looking for consultants to do more, assisting with productivity and helping support business growth.

Contributing to this outlook, consultants will increasingly leverage AI-powered tools to streamline processes, augment decision-making, and deliver more personalised solutions to clients. This technological integration is not just a trend, but a necessity driven by the growing complexity of the business environment.

The future of the profession

Key drivers of employee satisfaction in the consulting industry have shifted focus and, for the first time in six years, flexible working is the highest valued benefit.

In our 2024 Member Survey, renumeration was the highest driver of satisfaction, reflecting the cost-of-living crisis. The latest survey data reveals that appreciation for flexible working practices has grown significantly – making it the top benefit in terms of staff satisfaction, up to 37% from 30% in 2022 and 35% in 2023. Variety of project types now comes in second, with a rate of 33%, showing a positive trend over recent years (from 30% during 2023, and 28% in 2022).

The Young MCA

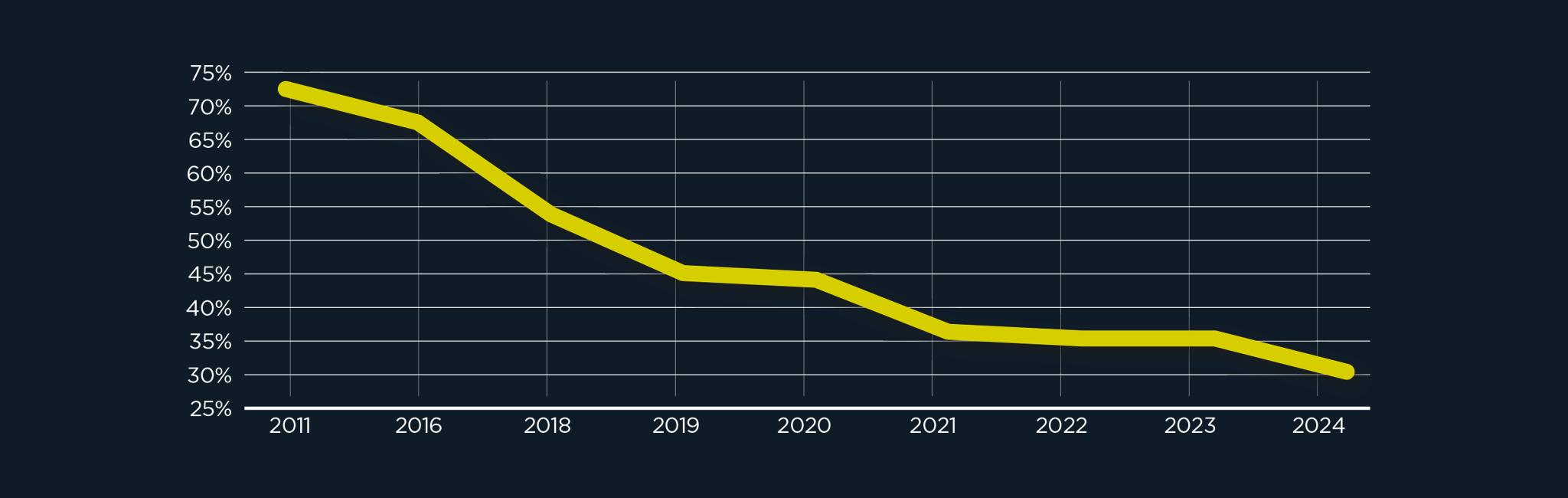

Data from the latest MCA Member Survey highlights the industry’s increasing commitment to inclusivity. The proportion of young consultants from Russell Group universities has decreased to 30% – a substantial drop from 73% in 2011. This significant change over time indicates a deliberate effort by consulting firms to enhance social mobility and attract talent from a broader range of educational backgrounds and regions across the UK.

The Report

For questions or queries regarding the 2025 MCA Member Survey please contact Caroline Florence.

caroline.florence@mca.org.uk

Tel: 020 7645 7959