Equiteq has analyzed thousands of consulting and professional services firms over the past decade. In fact we recently conducted research with the buyers of consulting firms to find out what they look for when buying consultancy firms. Although there is a wide range of buyer requirements, the most popular criteria for buyers was found to be consulting firms with revenues between $15m and $40m, stable financials, deep domain expertise and leverageable intellectual property.

Through our work and research we have gained a unique perspective on the financial metrics of consulting firms. These are important for firm owners to understand while they are growing their businesses and when it’s time to sell. This series will look at the important metrics, with the first exploring what a healthy consulting business looks like.

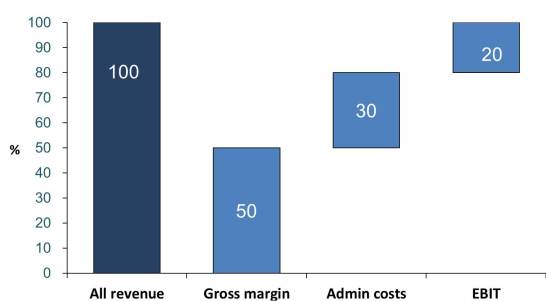

Below is a chart showing our view of the financial profile of a successful consulting firm. This is a general view and individual consultancies may vary.

Equiteq’s model profile

The first bar of 100% represents total revenue. The key thing to note is that not all revenue is created equal. We’re sure you have your own views on what types of engagements are better for your business, such as being more profitable or helping to add a more strategic string to your bow. Buyers will have their own views on the most valuable engagements and these can be a key driver of price in a sale process. We’ll go into more detail on revenue in the next blog of this series.

The 50% bar in this chart can either represent delivery cost, or its exact inverse – gross margin. This means that healthy consulting businesses have at least 50% margin after all the costs of delivering services are paid. Importantly, this does not mean that all partner costs need to be paid as part of this 50%, because often we find consulting businesses aren’t allocating partner time appropriately to the next category of expenses.

The next category of expenses is admin or overhead costs, which are the costs of running the business. This segment should come in at around 30% of costs. As mentioned above, it is important to make sure that the accounting is accurate. For example, if a partner spends 40% of her time selling, then 40% of her salary needs to be in the overhead bucket. If not, analyzing the resulting metrics won’t provide the correct answer! We have found that allowing 30% to be spent on admin and overhead costs provides a reasonable balance between investing in growth while not overspending on central infrastructure.

The remainder is EBIT, or Earnings Before Interest and Tax. EBIT (or EBITDA) is the accounting profit that is available for distribution to the owners of the business. Accurately positioning the true profit of a business is the most important numerical topic when entering a sale process or negotiation, so we will dive into much more detail on the topic in a subsequent blog.

While we will go into further details about each of these factors in future blogs, it is important to have an overall view of what kind of balance there should be in a healthy consulting business. If revenue growth is high but gross margin is low, questions need to be asked about pricing, or utilization, or the accuracy of the management tools used to run the business. Equally important, if overheads are too low a consultancy may be missing out on growth opportunities which could impact its sale price in the future. By having an understanding of what the profile in a consultancy should look like, owners can take steps to remedy problems and set their business up for future success.

Originally featured in Equiteq Edge.

Equiteq is an MCA Associate Member and the leading M&A advisor for consulting firms. Equiteq helps consulting firm owners to grow and successfully sell their firms, achieving maximum value for the consultancy owners.